Rebecca Chan on tax incentives for artists and making the most of Baltimore’s arts and entertainment districts.

Tax season is in full swing, and as you rush around collecting your 1099 documentation and looking for old receipts, I would also encourage you to take a look at a very useful, but often overlooked tax incentive for artists living and working in Maryland: the Maryland Arts and Entertainment Districts Income Tax Subtraction Modification for Individual Artists (aka the A&E District Income Tax Incentive).

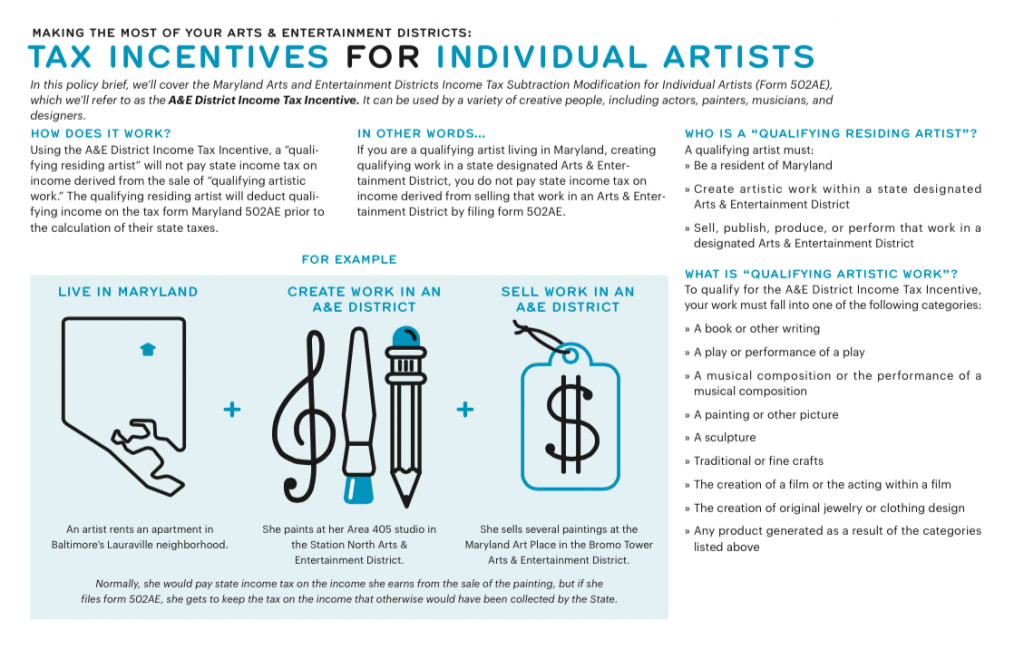

Here’s how it works:

If you are an artist that lives in Maryland, creates work in a designated Arts & Entertainment District, and then presents and/or sells that work in a A&E District you do not pay state income tax on the income derived from that work if you file form 502AE.

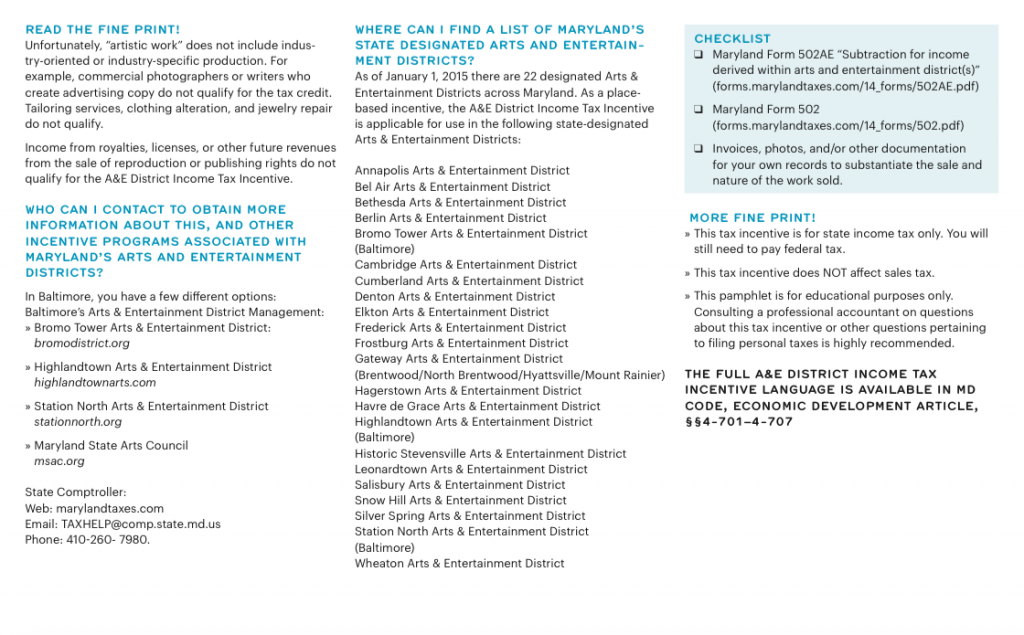

For those based in Baltimore, there are three areas of the city that are state-designated A&E Districts, and would therefore enable artists creating work in those Districts to qualify for the incentive: Bromo Tower Arts Arts & Entertainment District, Highlandtown Arts & Entertainment District, and Station North Arts & Entertainment District. A full list and map of all 22 of Maryland’s designated A&E Districts is available on the Maryland State Arts Council’s website.

Several great things about this incentive that are not immediately apparent:

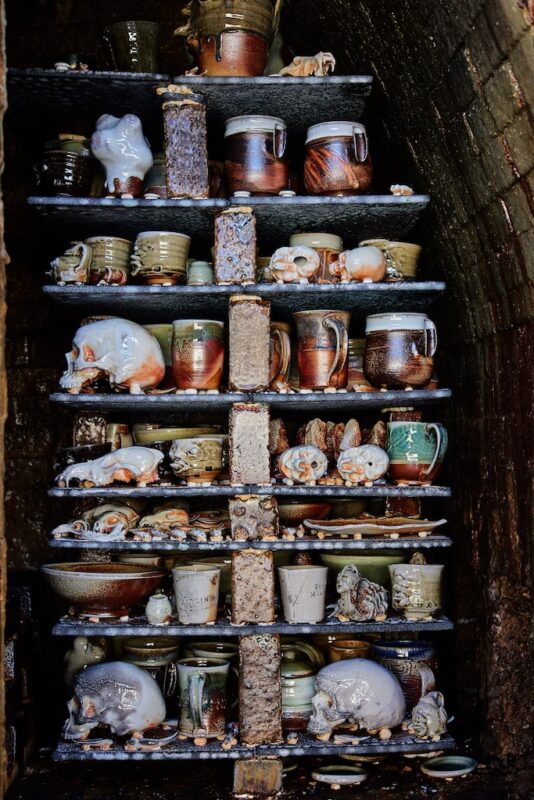

-The A&E Tax Incentive can be used by many different disciplines, including visual artists, writers, actors, designers, and other creative professionals.

-The A&E Tax Incentive works in, and in combination with, any A&E District in the Maryland. For example, if you are a sculptor with a studio in Baltimore’s Highlandtown A&E District, and then exhibited and sold a piece at a gallery in the Gateway A&E District in Hyattsville, the income you derive from that transaction is eligible for the tax incentive.

-The A&E Tax Incentive can be used on internet, mail order, and catalog sales, provided the work is created in a district, and is also shipped from within a district.

Read through the infographic below, as well as the tax forms to see if you qualify. And, as with all matters having to do with personal taxes, it is advised that you consult a professional accountant for questions pertaining to this tax incentive or other tax-related quandaries.

Author Rebecca Cordes Chan is a Baltimore-based arts administrator and is Program Officer at the Robert W. Deutsch Foundation.